- PYTHON SWAGBUCKS BOT HOW TO

- PYTHON SWAGBUCKS BOT CODE

PYTHON SWAGBUCKS BOT CODE

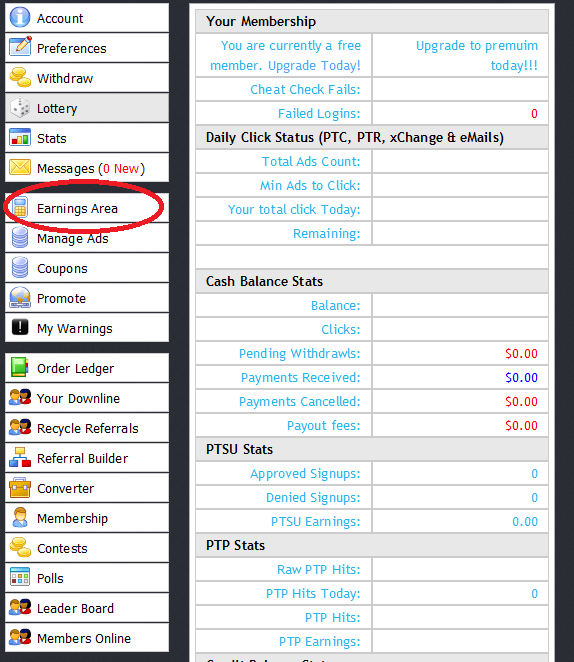

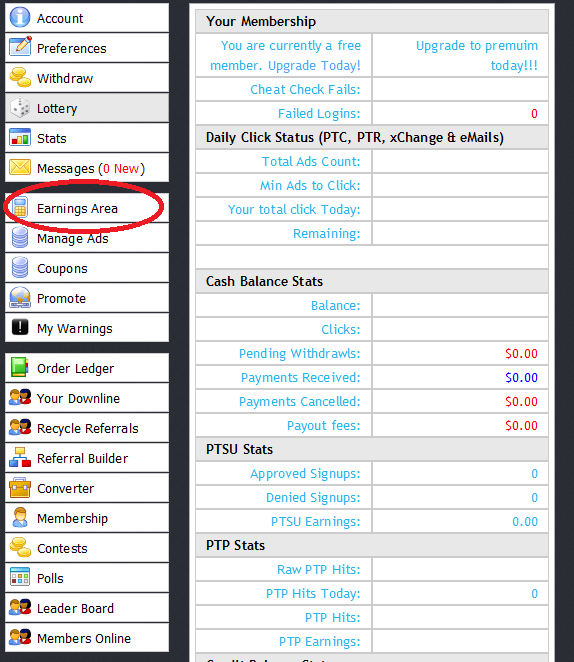

If the file doesn't exist, trigger an exception and execute the code in the except section, creating a new file.Īs long as the checkbox log output is enabled, you can follow the logging with the command-line tool tail: $ tail -f ~ /Pythonic_2020 /Feb /log_2020_02_19.txtįor development purposes, skip the synchronization with Binance time and regular scheduling for now. If it is present, then open it, concatenate new rows (the code in the try section), and drop overlapping duplicates. Then look inside the user's home directory ( ~/) for a file named TRXBTC_1h.bin. dump (df, open (data_path, "wb" ) )įirst, check whether the input is the DataFrame type. reset_index (drop = True, inplace = True ) load ( open (data_path, 'rb' ) )ĭf = pd. join (home_path, file_name )ĭf = pickle. To begin, you need the Binance OHLC Query element and a Basic Operation element to execute your own code.

This workflow may be a bit overkill, but it makes this solution very robust against downtime and disconnections.

Compare both datasets and extend the existing dataset with the newer rows. Load existing OHLC data from the file into memory. You can use Pythonic's built-in elements and extend them with your own logic. PythonicDaemon as the pure runtime (console- and Linux-only)įor a crypto trading bot to make good decisions, it's essential to get open-high-low-close ( OHLC) data for your asset in a reliable way. Pythonic, which is the overall framework. Jupyter Notebook for data-science tasks. Binance expert trading view (visualizing data has been done by many others, so there's no need to reinvent the wheel by doing it yourself). The following tools are used in this tutorial: For this tutorial, it will be called the trade factor. The pitch will be the main indicator for making decisions about trading. If the pitch falls below a certain value, the bot will place a sell order. If the pitch exceeds a certain value, it signals rising prices, and the bot will place a buy order. The bot monitors the pitch between the current EMA-25 value (t0) and the previous EMA-25 value (t-1). The purple line in the chart above shows an EMA-25 indicator (meaning the last 25 values were taken into account). Although a moving average may be a simple indicator, I've had good experiences using it. The EMA indicator is, in general, a weighted moving average that gives more weight to recent price data. The bot will make decisions based on exponential moving averages (EMAs). I choose these coins because of their volatility against each other, rather than any personal preference. It uses the example of trading Tron against Bitcoin on the Binance exchange platform. PYTHON SWAGBUCKS BOT HOW TO

This hands-on tutorial teaches you how to get started with Pythonic for automated trading. As I wrote in an introductory article last year, "Pythonic is a graphical programming tool that makes it easy for users to create Python applications using ready-made function modules." It originated as a cryptocurrency bot and has an extensive logging engine and well-tested, reusable parts such as schedulers and timers. There are a lot of commercial solutions available, but I wanted an open source option, so I created the crypto-trading bot Pythonic. The usual solution is to use a crypto trading bot that places orders for you when you are doing other things, like sleeping, being with your family, or enjoying your spare time.

Running Kubernetes on your Raspberry Pi. A practical guide to home automation using open source tools. 6 open source tools for staying organized. An introduction to programming with Bash. A guide to building a video game with Python.

0 kommentar(er)

0 kommentar(er)